Nigeria’s Equity Market Seeks Positive Economic, Company Data To Inspire Reversal

Market Update for June 28, 2018

The nation’s equity market on Thursday extended its bearish

sentiments that had lingered for three consecutive days, despite the inflow of

March year-end earnings reports and notification of closed period for half year

results. At this point, the market is seriously waiting for a positive economic

and company news to reverse the current trend as many players are trading

cautiously to minimize their losing positions.

Trading started with a little move to the downside, and

further pullback to retest the recent strong support level at 37,700.01 basis

points in the midday as highly capitalized stocks lost grounds to breakdown the

sideways ranging at 37,988bps to 37,962bps movement in the previous

sessions. Intraday volatility was high

as the benchmark index touched lows of 37,708.50 from highs of 37,977.25 and

rallied back up in the late afternoon to close session at 37,733.44. One of the

March year-end accounts- Redstar Express released its fully result (READ HERE),

offering 40 kobo dividend, which market is likely to react to between today and

next week, while Honeywell and Flour Mills are expected to hit the market

today.

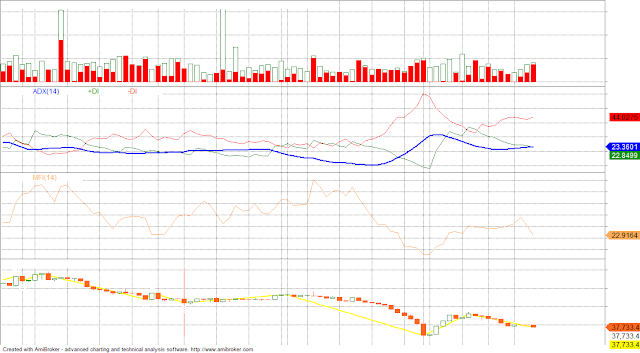

Thursday’s market technicals were negative and mixed as

traded volume was high in the midst of negative market breadth and sentiments,

as revealed by Investdata’s Daily Sentiment Report showing a ‘sell’ pressure of

91% and ‘buy’ volume of 9% on a volume index of 1.24 of the day’s total

transactions.

Momentum behind the market performance were weak and low to

reflect on the money flow index at 22.92 points from the previous day’s 31.17

points. This is an indication that funds are still leaving the market at the

end of Thursday trading. This also revealed the wait and see attitude of

bargain hunters who slowed down in their positioning ahead of the Q2 earnings

season and implementation of new pension assets classification funding that

will support long-term stability.

Index and Market Cap

The benchmark index on Thursday shed 230.49bps, closing at

37,733.44bps, after opening at 37,963.93bps, representing a 0.61% decline on a

high volume that was higher than the previous day’s. Similarly, market

capitalisation lost N83.56bn to close N13.67tr from an opening value of

N13.75tr, representing 0.61% value loss.

If you are hunting for the right stocks to buy on this

oscillating trend, join Investdata Buy & Sell Signal setup. We have a

watchlist of stocks for different investment purposes that you may position in,

as the market sets for another phrase of recovery. To register and become a

member send Yes or stocks to the phones numbers below. Our watch list has

increased due to the prolonged correction before now, take advantage of this

service to buy right and sell right.

The downturn recorded was due to price depreciation in low,

medium and high cap stocks like Dangote Cement, Guaranty Trust Bank, Zenith

Bank, FBNH, Dangote Flour, Oando, Diamond Bank, Sterling Bank, Fidelity Bank,

and Wema Bank. These impacted negatively on the NSE’s Year-to-Date return,

pushing it further down to 1.33%, while in market capitalisation gain for the

period stood at N4.68bn, a 0.25% rise above the year’s opening value, on the

impact of new listings earlier in the year.

Bullish Sector Performance

Sectorial performance for the day were seemingly bullish, except for the NSE Banking

that was down while the NSE Insurance, Industrial and

Consumer goods were up as Law Union Insurance, Aiico, Lafarge Africa, Dangote

Sugar Honeywell and Flourmill appreciated in value. Market breadth was negative

as decliners outweigh advancers in the ratio of 20:16 to keep the bear market

running.

Market activities were up in volume and value by 11.49% and

39.99% respectively to 414.93 million shares worth N4.45 billion from the

previous day’s 372.24 million units valued at N3.18 billion. The day’s volume

was boosted by trading in financial services and consumer goods stocks like

Champion Brewery, Sterling Bank, Zenith Bank, Guaranty Trust Bank and FBNH that

witnessed increased trading to top the activity chart.

Honeywell and Law Union Insurance were the best performing

stocks for the day, that topped the advancers’ table, with 9.52% and 9.3%

respectively to close at N2.41 and N0.84 each, due to market sentiments and

expected full year results

On the flip side, Equity Assurance and Wema Bank were the

worst performing, losing 4.55% and 4.11% each to close at N0.21 and N0.70 on

market forces.

Market Outlook

We foresee a reduction in the losing streak as more

impressive March accounts earnings reports hit the market today being the last

trading day of the week. Volatility is likely to continue while investors and

fund managers reposition for end of the quarter to earn good fee and commission

as equities remain undervalued with higher yields. Investors should review

their position in line with their investment goals and take action as events as

it unfolds in the global and domestic environment.

However, we would like to reiterate our advice that

investors should go for equities with intrinsic value, especially during this

season were less earnings are released ahead of march full year earnings

release and Q2 interim dividend payment

are expected in the market arena very soon.

We advise investors to allow numbers guide their decisions

while repositioning in any stock, especially now that stock prices remain

volatile amidst improving company, economic and market fundamentals.

Save The Date: Investdata Stock Market Training Workshop

On Saturday,

July 28, 2018

Theme- Comprehensive Stock Trading & Investing Toolkit

for Rest of 2018

Sub Topics

Review of 2018H1 Market & Economic Performance: How Fiscal Reforms and Stimulus Will Support

the Market/Economy in 2018H2.

In this presentation, the speaker will discuss how

historically the Fiscal and Monetary policies have influenced Nigeria’s stock

market, the implications for the second half and it would drive equity prices

higher as recovery continues.

2018H2 Trading Checklist: How to Find Winning Stocks in

Nigeria’s Volatile Equity Market

After the prolonged correction, volatility is here to stay

for the rest of 2018. Is it time to start worrying about losses suffered so

far, a flattening yield curve or time to relax due to the outstanding earnings

season? Better yet, is there a way to harness increased volatility to your

advantage? Our facilitator, a stock market expert will show you how to handle

increased volatility in 2018. He’ll offer insights into forces impacting

today’s market. He will share, using real-time examples, his ultimate checklist

to finding winning stocks propelled by volatility. This simple strategy allows

you to quickly evaluate stocks and to better time entry and exit points, while

understanding market forces moving your portfolio

How To Generate Consistent Superior Equity Returns and

Income With Dividend Stocks

Here, the expert will discuss his approach to generating

equity income by investing in undervalued dividend stocks, what he looks out

for when trading dividend stocks at a discount to historical valuations on

multiples of price to sales, earnings, cash flow, book value, and enterprise

value to EBITDA. In addition, he requires companies to have positive operating

cash flow over the past 12 months, with dividends covered comfortably by cash

flow.

Powerful Patterns and Effective Strategies for Trading

Shifts in Market Volatility

Recent and ongoing changes in market volatility present both

risks and opportunities for discerning traders. Learn some of the most

effective strategies for taking advantage of the high-probability trading

opportunities available in equities, while minimizing risks associated with

stock market trading. The six most powerful patterns in the market to trade,

how to know which patterns and strategies to specialize in for consistent

results and the critical difference between oscillating and momentum patterns.

Kindly call

or send yes to 08032055467, 08028164086 or 08111811223.

Ambrose

Omordion

CRO|Investdata

Consulting Ltd

info@investdataonline.com

info@investdata.com.ng

ambrose.o@investdataonline.com

ambroseconsultants@yahoo.com

Tel:

08028164085, 08032055467

Comments

Post a Comment