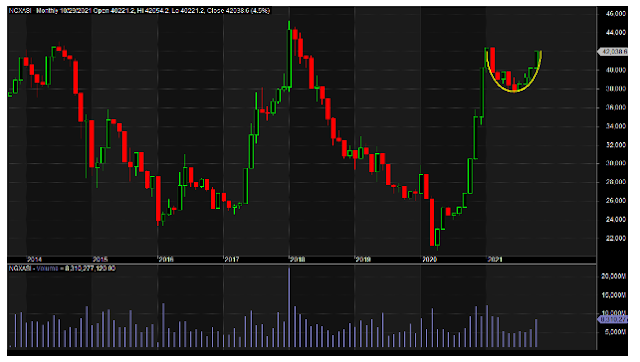

NGX Index May Sustain Oscillating Posture On MPC Outcome, Ahead TB Auction

Market Update for November 23 Volatility continued on the Nigerian Exchange on Tuesday as the benchmark index short-lived previous day’s positive outing, turning slightly negative to extend its sideways movement on a low traded volume. Market breadth was, however, positive as members of the Central Bank of Nigeria’s Monetary Policy Committee concluded their final meeting for the year, voting unanimously to retain all policy instruments unchanged, in what they said is to sustain the ongoing economic recovery, despite various headwinds like the fear of COVID 19 resurfacing in some climates and the oscillating oil price at the international market. The mixed sentiments and signals at the end of Tuesday trading indicates investors buying interest in blue-chips, especially those that had suffered losses in recent time but have a high possibility of dividend payout. Profit taking activities continued in some tickers ahead of midweek Treasury Bills’ primary market auction that will space th