MARKET UPDATE FOR THE WEEK ENDED 23 AUGUST, 2019

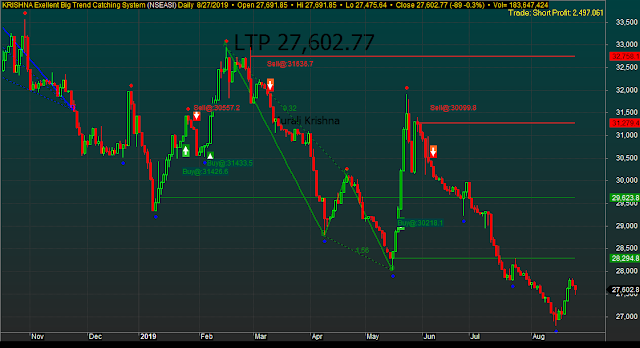

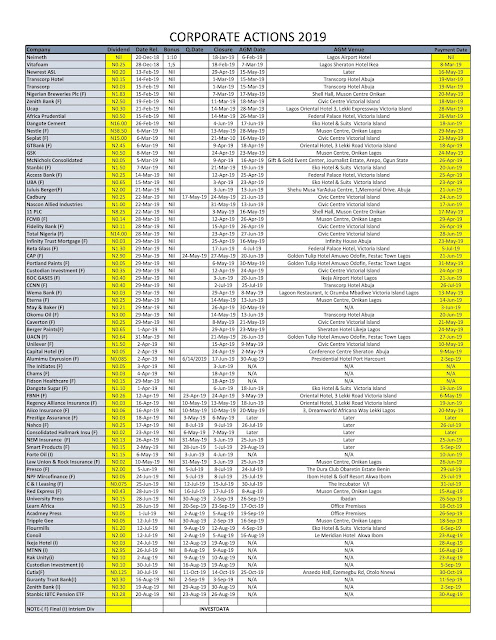

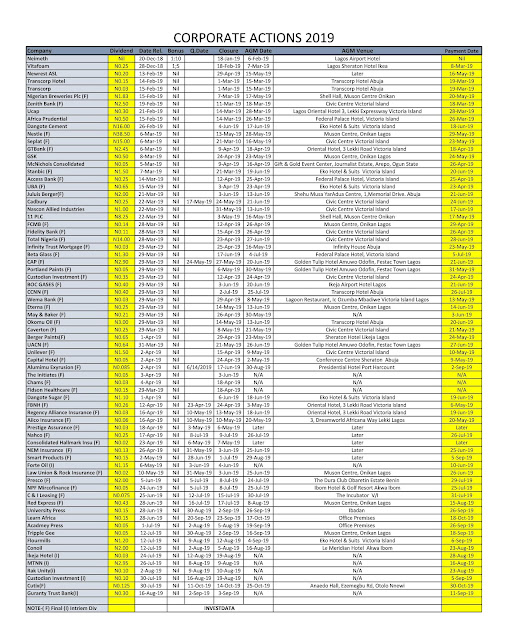

Dear Investors and Traders, Ambrose Here Again, Welcome to this amazing part of Market the Weekly Video Update precisely August 23rd. A lot really happened last the week so in the video, you will discover; 1. A general overview of the The market as at last week 2. Reasons why there was an increase in the share index. 3. Which position should traders and investors take? 4. Why market reversal is eminent? 5. . What members of the Buying and Selling Signal have benefited? 6. Which type of stock you should invest now.? 7. Others topics For further information on WHAT NEXT, call now 08028164085, 0803205546 Dedicated to Your Financial Success, Ambrose Omordion #valueinvesting #stocktrading #stocks #stockexchange #financialmarkets #currency #financeandeconomy #nigeria #centralbank #stockmarket #trading