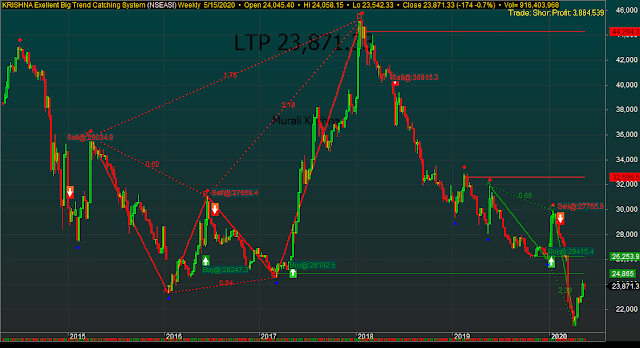

Investdata Daily Sentiment Report as of May 28, 2020

NSEASI buy 40% sell 60% volume index 2.08 MFI 83.60 Access buy 💯 volume index 1.06 MFI 87.84 Afrprud buy 0% volume index 2.37 MFI 67.00 Aiico buy 50% sell 50% volume index 2.23 MFI 81.89 Ardova buy 0% volume index 2.01 MFI 73.03 Caverton buy 💯 volume index 5.77 MFI 48.90 Chams buy 💯 volume index 3.72 MFI 59.61 Dangsugar buy 67% sell 33% volume index 2.80 MFI 75.88 Eti buy 67% sell 33% volume index 2.98 MFI 95.75 Fbnh buy 💯 volume index 2.75 MFI 73.46 Fcmb buy 17% sell 83% volume index 0.84 MFI 72.84 Fidelity buy 88% sell 12% volume index 2.05 MFI 85.66 Fidson buy 💯 volume index 0.83 MFI 71.50 Fmn buy 💯 volume index 1.10 MFI 65.35 GT buy 81% sell 19% volume index 2.22 MFI 68.79 Honyflour buy 0% volume index 1.98 MFI 81.42 Jaiz buy 💯 volume index 3.99 MFI 75.59 Jberger buy 💯 volume index 1.18 MFI 69.00 Lasaco buy 0% volume index 3.65 MFI 68.82 M&B buy 💯 volume index 1.53 MFI 50.01 Mtnn buy 💯 volume index 2.29 MFI 32.55 Nahco buy 💯 volume index 2.85