Reversal Imminent, As Investors Bet On Oil Price Rebound, Earnings Reports

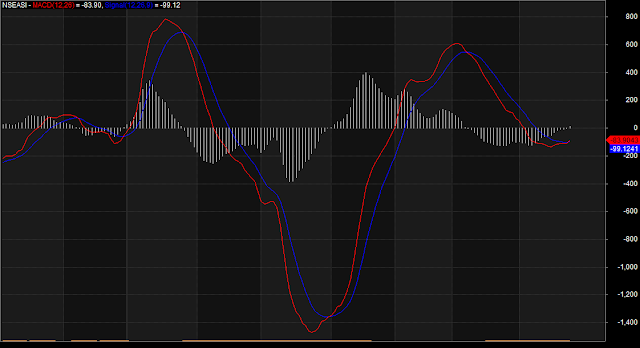

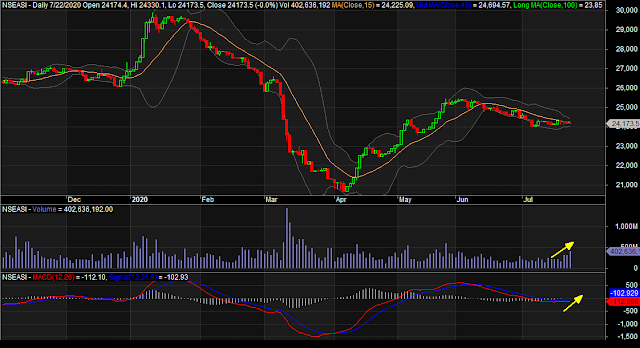

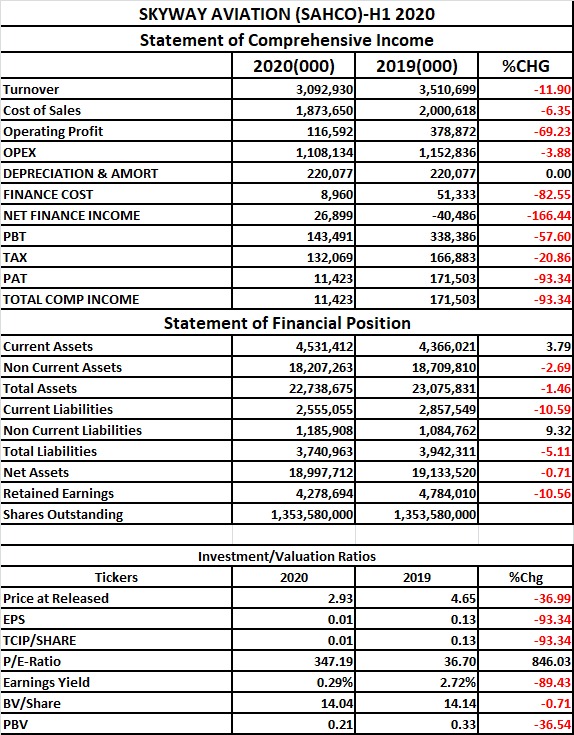

Market Update for July 28 The big winners from the previous session on the Nigerian Stock Exchange (NSE), slowed down on Tuesday, as mixed trend continued after a positive reaction to half-year earnings reports. The composite All-Share index closed south on a low traded volume to remain relatively above its 20 and 50-Day Moving Averages, supporting a recovery, while indicating ‘buy’ interests from smart money while Money Flow Index oscillated to read 37.82 points despite profit taking by short-term traders. The mixed earnings from Okomu Oil, Prestige Assurance and Mutual Benefits Assurance failed to impact the general market positively, despite influencing their share prices and sectoral performances for the day with investors reacting positively as revealed by the volume traded to top the gainers’ chart. The day’s negative slant was caused by oil/gas stocks which depressed the market due to unimpressive earnings reports that have so far emanated from the sector, as well as osci