NGSE Index Climbs Higher On Positioning, Year-end Window Dressing

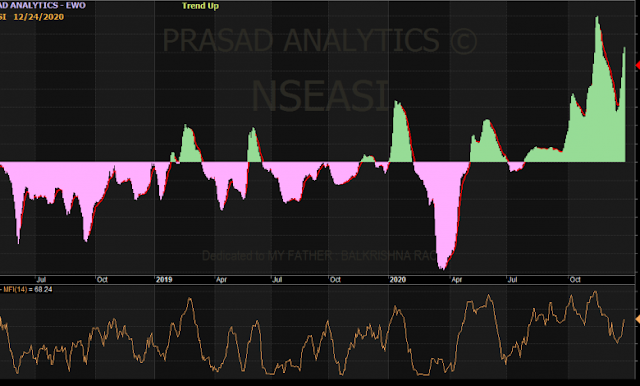

Market Update for December 29 Equity prices on the Nigerian Stock Exchange (NSE) climbed higher when trading closed on Tuesday after the Christmas holidays declared by the Federal Government on Friday and Monday, erasing the marginal loss of the previous session on a very high traded volume, amidst positive sentiments. Low priced stocks led price gains, just as more banking stocks joined the ongoing Santa Claus rally ahead of quarter and year-end window dressing activities, especially by institutional investors. Despite, the mixed and volatile session, the benchmark NSE All-Share index (NSEASI) made a new 52-weekhigh, breaking out the 39,000 psychological line on buying interests in industrial, banking and consumer goods stocks. This supported the index regardless of the seeming profit taking in stocks that rallied recently in the insurance, oil/gas and other sectors. As mentioned in our previous update, market reversal and uptrend are possible in the face of the 2020 year-end expect