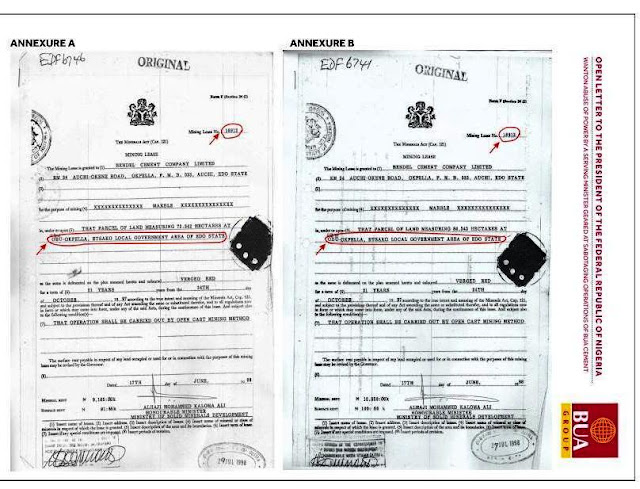

• It’s A Lie, You Can’t Intimidate Us Like You Did To Ibeto, Others, BUA Warns Photo Caption: Acting Chief Executive, Dangote Cement Plc, Engr. Joseph Makoju; Group Executive Director, Strategy, Capital Projects and Portfolio Development, Dangote Industries Limited, Devakumar Edwin; and Mining Consultant to Dangote Industries Limited, Taslim Jimoh, at a press briefing to debunk the claims by BUA Group on allegation of Dangote Cement sabotaging operations of BUA Cement in Edo and Kogi State, in Lagos on Sunday, December 17, 2017. The verbal war between Alhaji Aliko Dangote’s Dangote Cement Plc and his fellow billionaire businessman from Kano- Alhaji Abdulsamad Rabiu of BUA Group continued Sunday, over control of the nation’s lucrative multi-billion cement business. Both groups are at war over vast deposits of limestone, the major raw material for cement production. While Dangote Group has its Dangote Cement Plc listed and actually accounting for about a third of the market