Mixed Outlook Still, As Investors Realign Portfolios Ahead Of 2021Q1 Earnings

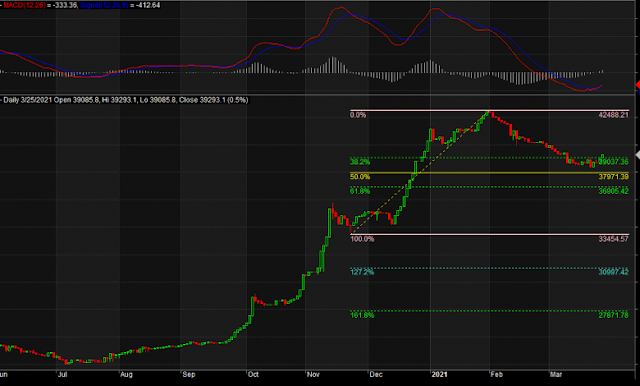

Market Update for March 30 The up and down movement on the Nigerian Stock Exchange continued as selloffs and profit booking hit the high cap stocks on the recent rally at the peak of earnings reporting season with more companies making available their numbers to market. This is just as the numbers released and dividend news remain mixed reflecting the strength of company financials and economic situation during the year 2020. This prevailing movement after correction is normal; especially as full-year earnings season is gradually winding down to usher in the 2021 Q1 reporting season, amid the month and quarter-end window dressing. The improving momentum, despite the mixed trend indicates that funds are entering the market as revealed by money flow index, due to dividend payout that continues to attract demand for blue-chip stocks in hot sectors with strong potential to grow sales in the current financial year as events in the economy unfold. The NSE’s index action has formed a min