NGSE Indices Soar, Amid Investor Safe Bets On Dividend Stocks, Rescheduled Elections

Market Update for February 20

Volatility continued the Nigerian Stock Exchange (NSE) Wednesday while the market consolidated its previous day’s gain on renewed investor, especially with investors placing safe bets on expected dividend declaration, especially from blue chip companies and high cap stocks.

The increasing buying momentum as revealed by high volume traded and high buying pressure as shown by our daily sentiment reports with buy position of 98%, was strong enough to reverse the bearish situation of the Transactional Corporation of Nigerian (Transcorp) following its low payout after an impressive 2018 full-year performance (READ), as well as Nigerian Breweries whose directors cut its dividend owing to weaker earnings.

Their share prices however rebounded at the mid-week, just as the high dividend yield of Zenith Bank impacted it stock price, following which it closed higher. Also, the impressive numbers by Newrest ASL regardless of its low payout and planned voluntary delisting (READ) has given an insight into what investors should expect from aviation companies.

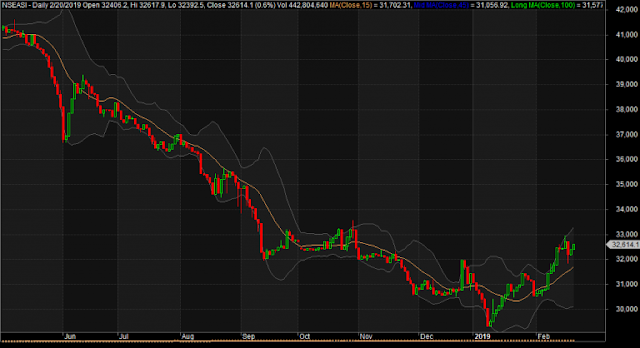

Meanwhile, the NSE All Share Index opened on Wednesday to the upside, it then pulled back to session lows of 32,392.46 basis points in the early hours and thereafter stair-stepped its way up to 32,617.94bps at midmorning. It then pulled all the way back down to below its opening figure before galloping up in the last few minutes to close the session at 32,614.05bps on a higher traded volume. The index bounced around over the rest of the afternoon, reaching session highs, and pulling back slightly to finish the day positive.

The expected certainty in the market, political correctness, economic policy reforms in the new dispensation after the February 23 polls and the ongoing earnings reporting season will determine the next direction of the market as global economic outlook still remains unstable, despite oscillating oil prices.

Market technicals at midweek were positive and strong with high volume traded that was higher than previous session’s in the midst of a positive breadth, while daily transaction volume index for the day stood at 1.22.

Energy behind the day’s market performance was high, reflecting the accumulation stage of the market as all eyes are on value stocks as shown by money flow index at 88.76 points, from previous day’s 82.86bps, indicating that funds are entering the market.

Index and Market Cap

At the end of midweek’s trading season, the composite NSE All Share Index gained 207.88bps, closing at 32,614.06bps, having opened at 32,406.18bps, representing a 0.64% growth, while market capitalization rose by N77.52 billion to close at N12.16tr, from the opening value of N12.08tr. This represented a 0.64% appreciation.

Attention: Join Investdata buy and sell signal setup to get all our in-depths analysis on the picture and to get access to our carefully created watch list. To become a member, send ‘YES’ or ‘STOCKS’ to the phone numbers below. The number of stocks on our watchlist has increased due to the prolonged market correction. Take advantage of this service to buy right and sell right during this earnings season and beyond.

The market maintained an upturn on the strength of demand for Nigerian Breweries, Guaranty Trust Bank, Zenith Bank, UBA and FBNH, among others, which impacted positively on Year-to-Date gains, lifting it to 3.77%, while that of market capitalization reached N346.86bn, from the year’s opening level of N11.72tr, representing a 3.77% growth.

Bullish Sectoral Indices

All sectoral indices were largely bullish, except for the NSE Industrial goods that closed lower. The NSE Consumer goods took the lead, chalking 1.43% on expected full-year results from stocks in the sector, even as market breadth remained positive as advancers outnumbered decliners in the ratio of 26:14.

Market activities were up in volume and value by 22.65% and 35.63% respectively to 443.78m shares worth N5.64bn, from previous day’s 361.82m units valued at N4.16bn, while the day’s volume was driven by financial stocks like: Sterling Bank, Guaranty Trust Bank, UBA, Access Bank.

Nigerian Breweries and Caverton were the best performing stocks during the session chalking 10% and 9.25% respectively to close at N82.50 and N2.48 on market forces; while the flipside was led by newly readmitted Goldlink Insurance and Custodian Investment, which shed 9.43%% and 62% respectively to close at N0.48 and N6.18 each, on market forces.

Market Outlook

The market rebounded on improved volume despite profit taking and volatility that continued as investors and traders repositioned for the 2019 dividend declaration season and post-election rally expected to shape market performance in the interim. We advise cautious trading and investing while positioning in fundamentally sound equities. We expect early filers like United Capital, Africa Prudential, and Forte Oil to hit the market with their numbers any time soon.

Volatility will also continue as investors and fund managers reposition their portfolios, with eyes fixed on political space, but investors should review their positions in line with their investment goals, strength of the company numbers and act as events unfold in the global and domestic environment.

However, we would like to reiterate our advice that investors should go for equities with intrinsic value,

We advise investors to allow numbers guide their decisions while repositioning in any stock, especially now that stock prices remain low in the midst of mixed company numbers, weak economic and market fundamentals

TAKE ACTION

The difference between you and others who are not aware of what I am sharing with you is ACTION. Take action that will transform your life throughout 2019 and beyond by getting the just concluded and life transforming INVEST 2019 TRADERS & INVESTORS SUCCESS SUMMIT Home study pack (USB) that you can play on your phone, Laptop and Television set.

The event, which held on Saturday, December 8, 2018, was yet another successful, insightful and educative outing that not only offered direction as to where investors should look for a profitable trade in 2019, insight into industries, sectors and companies to seek worthwhile returns. What stocks should you buy? Grab the pack for the 10 Golden Stocks with possibility of offering in 2019 multiples of what broader stocks do, coming out of this market correction environment

Don’t sit on the Fence call or text Stock to 08028164085, 08032055467, and 08111811223 now.

Ambrose Omordion

CRO|Investdata Consulting Ltd

info@investdataonline.com

info@investdata.com.ng

ambrose.o@investdataonline.com

ambroseconsultants@yahoo.com

Tel: 08028164085, 08032055467

https://investdata.com.ng/2019/02/ngse-indices-soar-amid-investor-safe-bets-on-dividend-stocks-rescheduled-elections/1

Comments

Post a Comment