Nigeria’s NGXASI Become More Attractive For Bargain Hunters, After 1.66% Slide

Market Update for June 15

Nigeria’s equity market on Tuesday had a very volatile and mixed session, closing lower on a very high traded volume but negative breadth, thereby extending profit booking from the recent rally for the second consecutive day as consumer goods stocks, especially those in agribusiness and telecomm come under pressure.

The selling sentiment as witnessed after the Democracy Day holiday is normal, given the recent price appreciation recorded by blue-chip and medium cap stocks, which to us in investdata is not surprising. This is because we have previously warned that a pullback after the market index has broken out the 39,000 mark will add more strength to the recovery move, with a high possibility of breaking out the 42,000 level, depending on the inflow of expected half-year numbers in the coming weeks.

The seeming positive economic data showing that Consumer Price Index for the month of May will come as a surprise to many, after Nigeria’s National Bureau of Statistics reported a further drop in the general prices of goods and services, or inflation rate by 19 basis point to 17.93%, from April’s 18.12%. This makes two months of slowdown in the nation inflation numbers as given by the statistics bureau, despite the geometric rise in food and other prices in the market, a situation that is blamed on the lingering insecurity across the country and the sustained devaluation of the Naira against other currencies across the globe. The misalignment may require explanation or provision of facts by the bureau to assure Nigerians that it providing real data from the fields.

It is not all bad news, after all, as oil price recovery continued at the international market with crude selling above $73 per barrel, which is 62.22% above the nation 2021 budget benchmark of $45pb.

This is expected to boost government revenue, enabling it meet the growing expenditure, while hastening economic recovery, and reduce the debt burden and borrowing propensity from the local and international capital market, provided there are buyers for the nation’s oil. We, however note that the impact of the surge in oil price is yet to reflect on the Nigerian economy, due to the budget implementation and disbursement style of government and its economic managers.

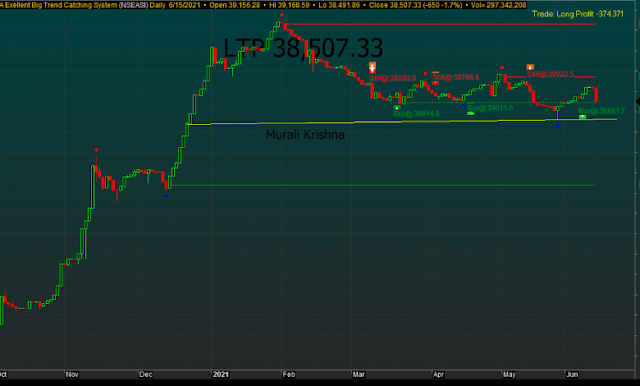

Meanwhile, Tuesday’s trading opened slightly on the upside and oscillated till midday before pulling back in the afternoon on selloffs in Airtel Africa and profit taking in blue chip stocks that pushed the NGX index action below the 39,000 psychological line to touch intraday low of 38,491.86bpfrom its highs of 39,168.59bps.

Market technicals were negative and mixed with volume traded higher than previous day in the midst of breadth that favoured the bears on high selling sentiments, as revealed by Investdata’s Sentiments Report showing 98% ‘sell’ volume and 2% buy position. Total transaction volume index stood at 1.21 points, just as momentum behind the day’s performance was relatively strong, as seen in the 60.13pts Money Flow Index, compared to previous day’s 61.12pts, indicating that funds left the market.

Index and Market Caps

At the end of Tuesday’s trading, the composite NGX All Share Index shed a significant 648.99bps to close at 38,507.33bps, from an opening level of 39,156.20bps, representing a 1.66% decline, just as market capitalization fell by N339.85bn, closing at N20.07tr, from its opening value of N20.41tr, also representing a 1.67% depreciation in value, higher than that of the index due to the delisting of Roads Nigeria, UNIC Diversified Holding, Evans Medical and Nigerian German Chemicals.

Attention: If you have not signed up for INVESTDATA buy and sell signal setup, don’t delay. As the number of stocks entering their buy range have just increased to 15 as they build new bullish base to be in our watchlist. These stocks are with double potentials to rally considering their earnings prospect and oscillating mood of the market.

To become a member, send ‘YES’ or ‘STOCKS’ to the phone numbers below. Take advantage of this service to buy right and sell right at the current oscillating market in the midst of earnings season, portfolio reshuffling and repositioning as we await an economic reform policy to stimulate and re-track the economy again.

Tuesday downtrend was driven by profit taking in stocks like Airtel Africa, Okomu Oil, Presco, Livestocks, Flourmills, Guinness, PZ, Vitafoam, UACN, NASCON, Dangote Sugar, Guaranty Trust Bank, Stanbic IBTC, and UBA, among others. This impacted negatively on Year-To-Date loss, as it increased to 4.38%, while the drop in market capitalization YTD jumped to N952.38bn, representing a 4.66% drop below its opening value for the year.

Bullish Sector Indices

Performance indexes across sectors were up, except for the NGX Consumer Goods that closed 0.18% lower, while the NGX Insurance led the advancers, after gaining 0.41%, followed by Banking and Energy with 0.16% and 0.13% higher respectively. Just as NGX Industrial goods was flat.

Market breadth closed negative, as losers outnumbered gainers in the ratio of 26:17; while activities in volume and value terms increased after traders crossed 297.35m shares worth N3.65bn, compared to the previous day’s 289.08m units valued at N3.55bn. Volume was boosted by trades in Access Bank, Sterling Bank, Zenith Bank, UACN and UBA.

Computer Warehouse Group and Berger Paints were the best performing stocks during the session, as they gained 9.73% and 6.72%, closing at N1.24 and N7.15 per share respectively on market forces and Q2 earnings expectations. On the flipside, Airtel Africa and Okomu Oil lost 10% and 9.44% respectively, closing at N753.5 and N105.5 per share, on selloffs and profit taking.

Market Outlook

We expect that a rebound is underway, as profit-taking may slow down on bargain hunters cashing in on these pullbacks to position for quarter end window dressing, seeming positive economic data ahead of March, April and May full year earnings reports. We note that half-year interim dividend stocks are becoming more attractive at this point for income investors and traders, even as the market anticipates positive news, while oil price continues to oscillate above $72pb to support global economic and stock market recovery across climates. We also expect the ongoing COVID-19 vaccination to support global and domestic economic recovery that will enhance the market and give direction.

The banking sector and others remain attractive on the back of the prevailing low prices, despite the Q1 mixed numbers.

Again, the way to go is: Target dividend-paying stocks and fundamentally sound companies with growth prospects in 2021, looking the way of mispriced equities ahead of interim dividend announcement. This is especially given that despite the seeming improvements, fixed income yield continues to offer a negative real rate of return due to the galloping inflation.

However, the strong and faster recovery may continue, depending on market forces, going forward, as propelled by expected Q2 earnings reports, until the next MPC meeting in July.

Ambrose Omordion

CRO|Investdata Consulting Ltd

info@investdataonline.com

info@investdata.com.ng

ambrose.o@investdataonline.com

ambroseconsultants@yahoo.com

Tel: 08028164085, 08179547605

Comments

Post a Comment