NGSE Poised For Fresh Inflows With Div Yield, As Oil Forecast To Hit $100/b In Cycle

Market Update for February 24

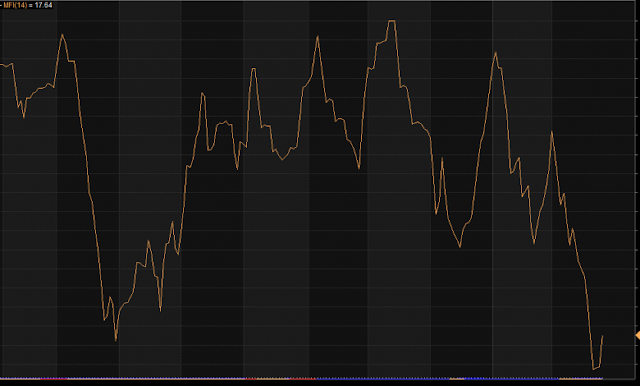

It was a mixed and very volatile session at midweek’s trading, as stock prices sustained the seeming rebound for the second consecutive session on an above average traded volume, signalling the gradual return of investors to the market. This was revealed by the money flow index reading 17.64 points from the previous session 9.35points, indicating that funds entered the market, even as rising yields in the fixed income market remain a threat to the equity segment.

Rates in that segment of the financial market, as shown in the just concluded Treasury Bills primary market auction at the midweek, which sustained upward momentum across all tenors. Rates of one-year bills increased to 5.5% from the previous auction rate of 4%, even as there was no redemption of maturing bills at the end of the auction.

This should guide you to target stocks with dividend yield of 7.5% and above for short period, since the equity market remains the best window for hedging against the nation’s spiralling inflation.

The renewed buying interest in banking, industrial and energy stocks during the session, as the dividend yields get better ahead of the month-end, when the market enters the peak month of its earnings reporting season for companies with December year-end.

With the mixed macro-economic indices emanating from the National Bureau of Statistics (NBS) and Central Bank of Nigeria (CBN), in the face of changing market trends and trading patterns, that is now of concern to retail and institutional investors, players in the equity market should invest wisely. One way of navigating the murky waters is to be guided by your set investment objectives, particularly entry and exit strategies, to survive and profit from the expected new trend.

In that way, should the full-year earnings reports and dividend news fail to impact and support the current trend, a big rotation in sector trends would also guide you, going into the future, especially as the NSE All-Share index action is trading currently in 50-Day Moving Average, after it had broken down the 14 and 20DMA on a daily time frame.

Midweek’s, trading started slightly in the green, before oscillating for the rest of the session, on profit taking and repositioning of portfolios ahead of month-end and dividend news. These pushed the benchmark index to an intraday high of 40.304.02 basis points from its lows of 40,149.18bps, before closing above its opening level at 40, 221.30bps.

Market technicals were positive and mixed, with volume traded higher than previous day’s in the midst of a flat breadth and mixed sentiment as revealed by Investdata’s Sentiments Report showing 47% buy volume and 53% sell position. Total transaction volume index stood at 0.85 points, just as energy behind the day’s performance remained weak, with Money flow index looking up to 17.64pts, from the previous day’s 9.35pts, indicating funds enter the market, despite the mixed sentiment.

Index and Market Caps

At the end of Wednesday’s trading, the All Share Index lost 56.44bps, closing at 40,221.30bps, after opening at 40,164.86bps representing 0.14% up. Market capitalization similarly rose by N29.53bn to close at N21.04tr from N21.01tr, also representing 0.14% value gain.

Attention: If you have not signed up for Investdata buy and sell signal setup, don’t delay. We have just added 20 STOCKS TO WATCH THAT ARE BUILDING NEW BULLISH BASE to our watchlist. These stocks are with double potentials to rally considering their current market value.

To become a member, send ‘YES’ or ‘STOCKS’ to the phone numbers below. Take advantage of this service to buy right and sell right at the current oscillating market ahead of earnings season portfolio reshuffling and repositioning as we await an economic reform policy to stimulate and re-track the economy again.

The day’s uptrend was driven by demand for stocks like Lafarge Africa, Oando, UBA, Access Bank, FBNH, Dangote Sugar, Zenith Bank, Guaranty Trust Bank, Transcorp, and Japaul Gold, among others. This impacted mildly on the Year-To-Date loss position by reducing it to 0.12%, just as market capitalization stood at N12.78bn or 0.06% below its opening value. The rush by investors to take position in Oando Plc, followed news on Tuesday of an Abuja High Court judgment against the suspension of the company’s Annual General Meeting almost two years ago. But the Securities & Exchange Commission SEC, in a statement on Wednesday, likened it to a Jankara judgment. (READ MORE).

Mixed Sector Indices

Performance indexes across the sector were mixed, as the NSE Oil/Gas, Banking and Industrial Goods closed 0.79%, 0.77% and 0.22% higher respectively, while the NSE Insurance led the decliners, after losing 1.87%, followed by Consumer goods with 0.32%.

Market breadth was at equilibrium, as decliners equal advancers in the ratio of 20:20; just as activities in volume and value terms were up by 18.82% and 97.33% respectively, after stockbrokers transacted 469.56m shares worth N7.08bn, as against previous day’s 356.92m units valued at N3.67bn. Volume for the session was driven by trades in Zenith Bank, Guaranty Trust Bank, FBNH, Transcorp and United Capital.

Oando and ABC Transport were the best performing, gaining 10% and 9.38% to close at N3.41and N0.35 per share respectively, on news of the court judgment. On the flip side, Lasaco Assurance and Consolidated Hallmark Insurance lost 9.49% and 8.33%, closing at N1.24 and N0.33 per share, on free fall after share reconstruction without earnings and fundamental to support the new price and profit taking.

Market Outlook

We expect the mixed trend and momentum to continue as renew buying interest by the bargain hunters support recovery move as more audited numbers are expected to roll in, with big global banks forecasting oil at $100 per barrel in the new oil supercycle that just started. Consequently, better dividend yield occasioned by price corrections that had created entry opportunities for discerning investors ahead of earnings expectations, will attract more funds to the market in a short term.

Again, the way to go is: Target dividend-paying stocks and fundamentally sound companies with growth prospects in 2021, looking the way of mispriced equities. This is especially given the rising oil prices that have so far supported the economy and equity market, despite the seeming improvement in the fixed income yield which had remained at negative real rate of return due to the subsisting high inflation.

However, the strong and faster recovery may continue, depending on market forces, going forward, as propelled by expected 2020 full earnings reports, until the next MPC meeting in March.

The NSE’s index action and indicators are in divergence on a low traded volume and positive buying sentiments.

Again, the current undervalued state of the market offers investors opportunities to position for the short, medium and long-term, which is why investors should target fundamentally sound, and dividend-paying stocks for possible capital appreciation in the new year.

Meanwhile, the home study packs on INVEST 2021 New Opportunities & New Paths To Profits Summit materials and 10 Golden Stocks for 2021, Strategies and How to invest profitably in this Changing Market Dynamics/ Recession, Mastering Earnings Season For Profitable Investing and Trading in any market situation/ cycles, Life Beyond COVID 19 Investment Opportunities In The Stock Market are now available. To obtain your pack send ‘Yes’ or ‘Stock’ to 08028164085, 08179547605, 08111811223 now.

Ambrose Omordion

CRO|Investdata Consulting Ltd

info@investdataonline.com

info@investdata.com.ng

ambrose.o@investdataonline.com

ambroseconsultants@yahoo.com

Tel: 08028164085, 08032055467

Comments

Post a Comment