Expect Reversal Amidst Cautious Trading, Buying Interests In High Cap Stocks

Market Update for December 24

Thursday’s transactions closed flat and mixed on the Nigerian Stocks Exchange (NSE), ahead of the Christmas holiday as some traders cashed out profit while others wait for the year-end window dressing and portfolio rebalancing ahead of 2021. Consequently, the market halted nine consecutive sessions of bull-run on a less-than-average traded volume, but on a positive breadth.

Putting it mildly, 2020 has been truly a mixed and challenging year for many market players. For investors, its been a tale of two markets, but those who have been able to stick to their investment plan, while following investdata’s buy and sell signal and ignoring market volatility, have fared well. Despite the prevailing economic situation, we are profiting and living through as players. We should all count our blessings and proceed to reposition our portfolios, staying with the 10 Golden Stocks for 2021.

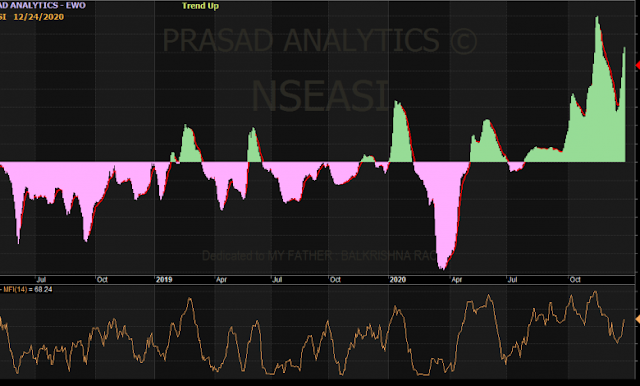

Despite the slowdown, market breadth remains positive and intact into the seasonal trend expectation even as additional stocks supported the Santa Claus rally, with the index trading above all the moving averages on the daily and weekly chart to indicate the presence of smart money. This is just as Thursday’s Money Flow Index revealed the inflow of more funds to the market.

However, we must warn at this point, that investors should not underestimate the possibility of market correction any time soon, because profit-taking is inevitable, even while the market has a trading pattern that supports an uptrend. The summary is: anything is still possible, considering the prevailing trade pattern as the index rally outside the upper limit of the Bollinger band.

Thursday’s trading started slightly on the downside and was sustained till midday before oscillating on profit taking and repositioning, a situation that pushed the NSE All-Share index to an intraday low of 38,798.18bps, from a high of 38,873.19bps, before closing below its opening figure at 38,800.01bps.

Market technicals were weak and mixed, with volume traded lower than the previous day’s in the midst of positive breadth and selling pressure as revealed by Investdata’s Sentiments Report showing 98% ‘sell’ volume and buy position of 2%. Total transaction volume index stood at 0.87 points, just as the energy behind the day’s performance was relatively strong, with Money flow index looking up at 68.24pts, from the previous day’s 62.55pts, an indication that funds entered the market in search of higher returns and yields, despite the market closing flat.

Index and Market Caps

At the end of Thursday’s trading, the benchmark NSEASI slipped 3.73 basis points, after opening at 38,804.10bps representing a 0.01% drop, just as market capitalization fell by N1.95bn to N20.28tr, also representing 0.01% value loss.

Attention: If you have not signed up for Investdata buy and sell signal setup, don’t delay. We have just added 20 STOCKS TO WATCH THAT ARE BUILDING NEW BULLISH BASE to our watchlist. These stocks are with double potentials to rally considering their current market prices.

To become a member, send ‘YES’ or ‘STOCKS’ to the phone numbers below. Take advantage of this service to buy right and sell right at the current market recovery ahead of portfolio reshuffling and repositioning as we await an economic reform policy to stimulate and re-track the economy again.

The downturn was driven by profit booking in Lafarge Africa, Guaranty Trust Bank, UBA, AIICO, Cutix, May & Baker and others. This impacted mildly on Year-To-Date gains, which fell to 44.55%, just as YTD gain in market capitalization soared to N7.32tr, representing a 51.02% growth.

Mixed Sector Indices

The sectorial performance indexes were largely bearish, except for NSE Insurance and Oil/Gas that closed 2.13% and 0.95% higher, while NSE Industrial Goods led the decliners after losing 0.23%, followed by Banking and Consumer Goods that closed 0.22% and 0.03% lower respectively.

Market breadth was positive, as advancers outnumbered decliners in the ratio of 23:8; activities in volume and value terms were down by 74% and 57.49% respectively as investors exchanged 389.72m shares worth N7.97bn, as against previous day’s 1.5bn units valued at N18.75bn. Volume was driven by Zenith Bank, Guaranty Trust Bank, Flour Mills, Lafarge and Lasaco.

FTN Cocoa and Lasaco were the best performing stocks gaining 9.88% and 9.68% respectively, to close at N0.89and N0.33 per share, on market sentiment. On the flip side, Champion Breweries and Jaiz Bank lost 7.89% and 4.76% respectively, at N0.82 and N0.60 per share, on profit taking and market forces.

Market Outlook

We expect a reversal in the next trading session as buying interests in highly capitalized stocks that control 70% of the market cap rekindle again, despite the cautious trading as other stocks that drive the Santa Claus rally are waking up in terms of price appreciation ahead of year end window dressing. There is also the interplay of market forces, as traders and investors interpret the impact of funds rotation and the current happens globally. Investors should, at this point, target solid stocks selling at discount in the midst of the ongoing cautious trading, portfolio diversification ahead of seasonal trends and expectations.

A breakout of 36,000 points will confirm a new uptrend as the market awaits the circular flow of funds to settle in higher yields instruments with a shorter timeframe, while waiting to see the impact of the adjustment in CBN policies. A breakout of this resistance level will create buy opportunities for discerning traders and investors.

Also important is the fact that technical indicators reveal overbought on the weekly and daily chart, while RSI reads 70 points and above, a situation that supports the likelihood of another correction.

However, the strong and faster recovery may continue, depending on market forces, going forward, as propelled by the quality of Q3 earnings presented, especially by the tier-1 banks, even as analyses of numbers released so far have helped repositioning of investors’ portfolios on the strength of sectoral and company’s performances.

The NSE’s index action and indicators are looking up in the same direction on a very high traded volume and positive buying sentiments.

Again, the current undervalued state of the market offers investors opportunities to position for the short, medium and long-term, which is why investors should target fundamentally sound, and dividend-paying stocks for possible capital appreciation in the rest of the year.

Meanwhile, the home study packs on INVEST 2021 New Opportunities & New Paths To Profits Summit materials and 10 Golden Stocks for 2021, Strategies and How to invest profitably in this Changing Market Dynamics/ Recession, Mastering Earnings Season For Profitable Investing and Trading in any market situation/ cycles, Life Beyond COVID 19 Investment Opportunities In The Stock Market are now available.

To obtain your pack send ‘Yes’ or ‘Stock’ to 08028164085, 08032055467, 08111811223 now.

Ambrose Omordion

CRO|Investdata Consulting Ltd

info@investdataonline.com

info@investdata.com.ng

ambrose.o@investdataonline.com

ambroseconsultants@yahoo.com

Tel: 08028164085, 08032055467

Comments

Post a Comment