Market Update for September 24, 2018

The week started with Monday closing as another tough and volatile session on the Nigerian Stock Exchange (NSE), as the seeming bull transition was halted and the benchmark All-Share index closing lower on a low volume traded.

This followed profit taking by traders in blue chips stocks that had rallied recently, amidst the anxious wait for the outcome of the Central Bank of Nigeria (CBN) Monetary Policy Committee (MPC) meeting before the end of Tuesday. The possibility of another unanimous vote to hold rates for the umpteenth time is high, given the latest (August) inflation data released by the National Bureau of Statistics (NBS); added to the steady decline in the nation external reserve (READ MORE). As at September 21, 2018, according to the latest filing on the CBN website as at Monday, September 24, 2018, Nigeria’s reserves was down further to $44.825bn, despite continued jump in oil price (Brent Crude) to a four-year high at $80.94 per barrel, before the marginal slip to $80.75pb on Monday, the highest since November 2014. The exit of foreign investors in droves and declining non-oil export has not helped matters.

Also the political environment becoming more unpredictable, going by the outcome of last weekend’s Osun State governorship election, declared inconclusive by Independent National Electoral Commission (INEC). Local and international observers have since expressed worry over the outcome of the Osun poll and that of Ekiti before it, which they say are casting doubts over the possibility of free and fair polls in next year’s general elections across the country.

Such anxiety is likely holding the market down with little oscillation, until after the February 2019 Presidential poll that would act as a compass for the country over the coming four years.

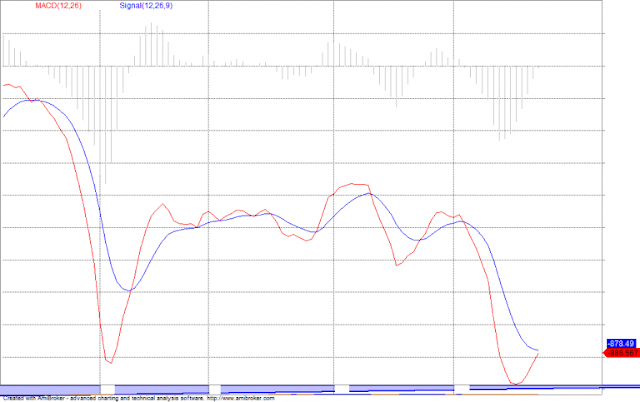

The NSE composite index opened the day slightly in the upside at the morning session, before sliding down between mid-morning and midday, after which it retraced up marginally in the afternoon, after touching intraday lows of 32, 427.54 basis points from a high of 32,577.92bps. It then finished the session lower at 32,451.27bps, following which MACD at the end of trade showed a convergence to support the expected short-term rally. Market sentiment turn positive on the expected outcome of the MPC meeting.

Despite the current situation in the market, the expected Q3 earnings numbers will reveal the true state of many companies and indeed, the economy. Identifying when to buy or sell matters a lot. This is what technical analysis will do for you. The market is preparing to produce another set of billionaires for 2019 and beyond. That is why you should go for HOME STUDY PACK of the Stock Trading Workshop held by Investdata Consulting on July 28, 2018. These are audio-visual materials you can play to view the live class on your phone and laptop to help you know when to jump into the market and specific stocks, or stay out. For your Pack, call or send ‘YES’ to the phone numbers below.

Market technicals for the day were negative and mixed, with high selling pressure on low volume and negative market breadth as showed by Investdata’s Daily Sentiment Report, showing a ‘sell’ position of 84% and ‘buy’ volume at 16%. Volume index was 0.82 of the day’s total transactions.

The forces behind the day’s market performance was weakened, as revealed by the money flow index at 43.89bps, down sharply from previous day’s 51.65bps, indicating that funds left some stocks as profit taking resumed again.

Index and Market Cap

At the end of trading, the NSE All Share Index shed 88.90bps, or 0.27%, closing at 32,451.27bps, after opening at 32,540.17bps; marketcapitalisation fell by N32.45bn to close at N11.85tr from N11.88tr, also representing 0.27% slide.

However, this is not the time to be loner. Join the Investdata Buy & Sell Signal setup, where you can look over our shoulder and follow to know when to hold cash and take advantage from our watchlist of stocks, for your different investment purposes. You can then take position for maximum gains in the coming weeks and months, given that the lingering market decline has and continues to create new entry opportunities. To become a member, send: YES or STOCKS to the phone numbers below. The number of stocks on our watch list has increased due to the prolonged correction. Take advantage of this service to BUY and SELL right.

Monday’s downturn was impacted by losses suffered by medium and high cap stocks, like: NB, Lafarge Africa, Forte Oil, Oando, Access Bank, FBNH, Dangote Flour and Fidelity Bank, among others. This impacted negatively on the NSE’s Year-to-Date return, as the day’s loss brought it to 15.14%, while market capitalization for same period had fallen to N1.76tr, or 12.94% from the year’s opening value.

BearishSectoral Performance

The sectorial indexes were largely bearish on Monday except for the NSE Banking and Insurance that closed green, as the undervalued state of financial stocks remains an attraction that supported Monday’s rally in that sector.

Market breadth was negative as decliners outweighed advancers in the ratio of 23:13, even as transactions in volume and value was down 63.39% and 68.75% respectively, to 190.57m shares worth N3.31bn, from previous day’s 523.44m units valued at N10.58bn. This was largely driven by financial services and conglomerates stocks like: Guaranty Trust Bank, Transcorp, UBA, Fidelity Bank and Diamond Bank.

Niger Insurance and Lasaco Assurance were the best performing stocks, topping the advancers’ table after chalking 9.68%and 6.45% to close at N0.34 and N0.33 each respectively, just due to low-price sentiments as the sector swings into the recapitalization mode. On the flip side, Livestock Feeds and Union Bank were the worst performing, shedding 9.52% and 9.48% of their opening value respectively to close at N0.57 and N5.25 on market forces and profit taking.

Market Outlook

We expect the market to maintain the same mood till it will pick up again ahead of quarter-end window dressing by fund managers that want to balance their trading account for their fees, which will usher in the Q3 earning season in October. We are in a season of rising oil price, expecting new policy statement and reform that would stimulate the economy again.

The ongoing volatility is likely to persist as bargain hunters take advantage of the low-price regime, in the midst of continued selloffs and political risk, especially as shadow elections by political parties kick off any moment from now.

Already, investors are looking forward to Q3 earnings reports so as to rebalance their portfolios and watch the political space.

Meanwhile, analysing the actual numbers released has given basic insights into company earnings that are likely to drive prices and determinemarket valuation.

Investors should review their positions in line with investment goals, vis-à-vis strength of company numbers and act as events unfold in the global and domestic environment.

However, we would like to reiterate our advice that investors should go for equities with intrinsic value,

We advise investors to allow numbers guide their decisions while repositioning in any stock, especially now that stock prices remain volatile amidst mixed company,economic and market fundamental.

Attention

The difference between you and others who are not aware of what I am sharing with you is ACTION. Take action that will transform your life for the rest of 2018 and beyond by getting the Just Concluded and life transforming seminar Comprehensive Stock Trading Toolkits for the Rest of 2018 Home study pack USB that can play on your phone, Laptop and Television.

Don’t sit on the Fence call 08028164085,08032055467 ,08111811223 Now

Ambrose Omordion

CRO|Investdata Consulting Ltd

info@investdataonline.com

info@investdata.com.ng

ambrose.o@investdataonline.com

ambroseconsultants@yahoo.com

Tel: 08028164085, 08032055467

https://investdata.com.ng/2018/09/anxiety-persists-on-ngse-as-bargain-hunters-take-advantage-of-low-price-regime/

Comments

Post a Comment