Nigerian Equity Index Suffers Reversal, Amidst Profit Taking, Weakened Money Flow

Nigeria’s equity market, on Wednesday, closed lower again, reversing previous day’s gain, oscillating amidst volatility, driven by resumed profit taking in highly capitalized equities amidst weakened money flow. The reversal was despite the market entry into the peak of Q1 earnings season, and notwithstanding the relatively impressive numbers emanating from quoted companies so far.

The volatility has become of serious concern to investors, as money flow index continues to move up and down, reflecting weak liquidity in the market arena which had also reflected on the volume traded since the side-trending started on April 10.

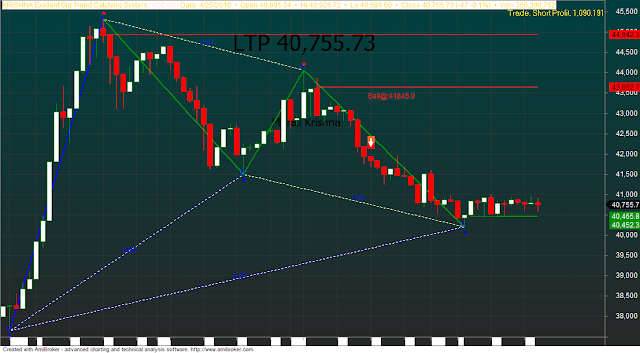

However, the day started out with a marginal gain, which held during mid-morning session before it rallied sharply to consolidate at midday, tested intraday highs of 40,926.72 (which is becoming the recent resistance level). It pulled back to a low of 40,589.60 by the afternoon on the strength of value loss by high cap stocks, before retracing up in the last trading minutes of the session, closing at 40,755.73 on a low volume that is below the market traded average.

The foreign portfolio investment flows report for March has actually revealed and supported INVESTDATA’s position that foreign investors are stylishly exiting the market, judging from percentage outflow for the period, which was higher than inflows despite the increase in transactions for the month of March. The prevailing trading pattern in the market revealed a sustained cherry-picking of dividend stocks by smart money and the seeming indecision among short term players. Any breakdown or rally by the market at this point will be massive. So, steady your gaze at this level.

Market technicals at midweek’s trading were positive and mixed as volume traded was low amidst a improving buying pressure and positive market breadth. The buying position was 49%, while selling volume was 51% on a volume index of 0.84 of the day’s total transaction. Arising from the day’s reversal, money flow index lost 42.26 basis points, compared to previous day’s 49.54 points notch, an indication that funds left the market

Index and Market Cap

The composite NSEASI dropped slightly 47.05points to close at 40.755.73 basis points after opening at 40,802.78bps, representing a 0.11% decline on a low volume that was higher than previous day’s. Similarly, market capitalisation went south, shedding N16.54bn to close at N14.72tr from an opening value of N14.74tr, also representing 0.11% value loss which kept investors in their losing position.

The downturn recorded was due to price depreciation in Total Nigeria, Dangote Cement, FBN Holding, an apparent indication that investors were not enamoured by the 25 kobo dividend per share offered by its directors as they released its delayed audited result for the full-year ended December 31, 2017. The market also ignored the impressive growth in net profit, helped by the huge reduction in provisioning for loan loss during the period (READ). Others stocks that contributed to the day’s index slide included: Lafarge Africa, whose Q1 outing also failed to give any sign of hope that current year could be different from the last when the company reported huge loss after tax (READ); while Oando and Zenith Bank suffered profit taking. The reversal impacted negatively on the NSE’s Year-to-Date returns, to contract at 6.57%, just as market capitalisation gains for the period stood at N1.11tr, representing 8.17% above the year’s opening value.

Bullish Sector Performance

Sectorial performance for the day was bullish except for the NSE Industrial and insurance that were down as a result of selloffs in Dangote Cement, Lafarge Africa and Continental Reinsurance, while the NSE Oil/Gas, Banking and Consumer goods closed north, due to value gain in Seplat, Forte Oil, Nestle, Guaranty Trust Bank and UBA.

Market breadth was positive as advancers outnumbered decliners in the ratio of 24:22 to short-live the two-day bear market.

Market activities were up in volume and value by 42.1% and 43% respectively to 350.99m shares worth N4.6bn from the previous day’s 246.58m units valued at N3.22bn.

Transaction volume was boosted by financial services and consumer goods stocks like FBNH, UBA, Fidelity Bank, Access Bank and Flourmills, all of which witnessed increased trading to top the activity chart.

The best performing stocks for the day were Forte Oil and Presco that topped the advancers’ table with gain of 10.16% and 5.00% respectively to close at N47.70 and N69.30 each. This was due to positive market sentiments.

On the flip side, FBNH and Skye Bank were the worst performing, after losing 8.96% and 5.73% respectively to close at N12.20 and N0.82 on profit taking, boosted by other heavy weights that enhanced the reversal.

Market Outlook

We expect a reversal as investors react to earnings reports that are hitting the market in the midst of profit taking and expected Q1 GDP data likely to be supported by monetary stimulus and extraneous factors like upswing in oil price, among other global events now closely under watch.

Even so, value investors continue to position for the short and long-term on the strength of company fundamentals.

However, we would like to reiterate that investors should not panic but go for equities with intrinsic value, especially during this season when dividend payment is ongoing and Q1 results are expected in the market arena.

We advise investors to allow numbers guide their decisions while repositioning in any stock, especially now that stock prices remain volatile amidst improving company, economic and market fundamentals.

It is time to combine fundamentals and technical tools to take decision by knowing the support and resistant level to reposition or exit any position. A stock market is in cycles. You must know the cycle it, or particular stocks therein are to successfully manage your trading and investment risk. For stocks that should be on your shopping list to buy in these seasonal changes as the year unfolds, sign up to INVESTDATA BUY AND SELL signal setup by calling 08032055467.

Get your home study pack of the INVEST 2018 Traders & Investors Summit and ride with the current recovery on Nigeria’s stock market and economy, thereby ensuring that you invest and trade with knowledge. You can also access stocks analysed in the home study pack of the Chart Summit held on February 24, 2018, including the 15 stock-picks for 2018 are available now to guide your positioning as trading for the year.

Comprehensive training materials on stock Trading and Investing for Financial Independence series are Available, you can play and watch on your mobile phone, laptop, desktop and TV set. Kindly call or send yes to 08032055467, 08028164086 or 08111811223.

Ambrose Omordion

CRO|Investdata Consulting Ltd

info@investdataonline.com

info@investdata.com.ng

ambrose.o@investdataonline.com

ambrose.o@investdata.com.ng

ambroseconsultants@yahoo.com

Tel: 08028164085, 08032055467

http://investdata.com.ng/2018/04/nigerian-equity-index-suffers-reversal-amidst-profit-taking-weakened-money-flow/#more

Comments

Post a Comment