Fear Of Rate Adjustment At Next MPC Meeting Halts NGSE Rally, As Investors Book Profits

Market Update for January 21

Trading on the Nigerian Stock Exchange (NSE) on Thursday experienced a high volatility and mixed session to resume another round of profit taking as market players look to the outcome of next week’s Central Bank of Nigeria (CBN) Monetary Policy Committee (MPC), amidst fear that was heightened by the latest FGN Bonds which reopened on adjusted and juicier rates for long tenored bonds.

This signals the possibility of a change in monetary policy, depending on the voting pattern of MPC members during their meeting, the first for the year, holding next week.

However, Investdata believes that if the low rates and unconventional monetary policy of the CBN is to drive economic recovery and create jobs for Nigerians, then the possibility of increasing rates is slim. But, if the goal is to checkmate the rising rate of inflation, the likelihood of an upward adjustment in rates is high.

Looking at the rate and pattern of profit booking across the market, one can safely conclude that investors in the market are undecided and playing cautiously, undecided about the next direction of the NSE’s composite All-Share index as it continues to side-trend or range, after forming a double top. Recall that rates have been kept low to encourage cheaper borrowing to rejuvenate the economy, and enhance recovery from recession, a decision that pooled funds towards the stock market in search of better returns. This has also lifted the NSEASI to its current level.

Analysts fear that bond rates ratcheting up by 195 basis points on the 25-year and 180bps on the 15year, while the Primary Market Auction closed at 8.95% and 8.74% respectively, could apply the brake on the ongoing bull-run in the equity space. This, they argue, is especially as the market is ripe for profit taking or correction, especially as the market has been within the overbought region for a long time now. The rising inflation rate has been a threat to the prevailing low interest rates regime which requires the urgent attention of the fiscal and monetary authorities, even as the economy awaits policies that will drive recovery and growth this year.

Nevertheless, given the trading pattern and sharp uptrend that brought the key performance index to this current level, we once again, suggest that investors should take profit in positions they have made between 15-30% so far and wait to re-enter later.

Thursday’s trading opened slightly on the downside and oscillated throughout the session on profit taking and positioning in mispriced stocks that have high dividend yields as the 2020 full-year earnings season draws nearer. This situation pushed the All Share index to an intraday low of 40,997.39 basis points, from its highs of 41.157.70bps, before closing the session below its opening level at 41,099.15bps on a very high traded volume.

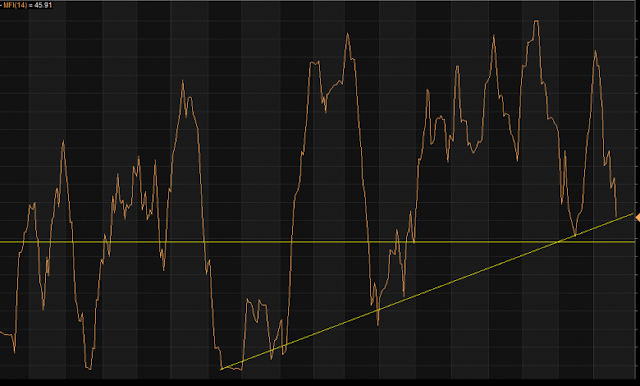

Market technicals for Thursday were mixed and weak, with higher volume traded than the previous day’s in the midst of negative breadth and mixed sentiment as revealed by Investdata’s Sentiments Report showing 63% ‘buy,’ and 37% sell position. Total transaction volume index stood at 2.10 points, just as the momentum behind the day’s performance turned weak, while Money flow index dropping to 45.91pts, from the previous day’s 55.84pts, indicating that funds left the market as profit taking resurfaced.

Index and Market Caps

At the end of Thursday’s trading, the NSE’s benchmark index slipped by 48.57 basis points, closing at 41,099.15bps from its 41,147.72bps opening level, representing a 0.12% drop. Similarly, market capitalization fell by N25.41bn, closing at N21.5tr, from opening value of N21.53tr, representing a 0.12% value loss.

Attention: If you have not signed up for Investdata buy and sell signal setup, don’t delay. We have just added 20 STOCKS TO WATCH THAT ARE BUILDING NEW BULLISH BASE to our watchlist. These stocks are with double potentials to rally considering their current market value.

To become a member, send ‘YES’ or ‘STOCKS’ to the phone numbers below. Take advantage of this service to buy right and sell right at the current market recovery ahead of portfolio reshuffling and repositioning as we await an economic reform policy to stimulate and re-track the economy again.

The day’s downtrend was driven by selloffs in Dangote Cement, MTNN, UBA, Dangote Sugar, Guaranty Trust Bank, and Flour Mills, among others, cutting the NSE’s Year-To-Date gain mildly to 2.06%, just as YTD gain in market capitalization stood at N442.66bn, or 2.23%.

Mixed Sector Indices

The sectorial performance indexes were largely bearish, except for the NSE Industrial Goods and Energy indexes that closed 0.27% and 0.15% higher respectively, while the insurance index led the decliners afterlosing 6.70%, followed by Consumer Goods and Banking, with 0.30% and 0.23% lower respectively.

Market breadth turned negative, as decliners outweighed advancers in the ratio of 50:14; just as activities in volume and value terms improved by 72.61 and 38.72% respectively as investors exchanged 1.12bn shares worth N6.4bn from the previous day’s 649.65m units valued N4.61bn. The day’s volume was driven by trades in Transcorp, Guaranty Trust Bank, Sovereign Trust Insurance, Mutual Benefits Assurance and Universal Insurance.

The best performing stocks for the session were NNFM and Multverse, as they garnered 10% each, closing at N9.86 and N0.22 per share, on earnings expectations and market forces. On the flip side, Chams and Prestige Assurance lost 10% each, closing at N0.27 and N0.54 per share, on market forces and profit taking.

Market Outlook

We expect the mixed trend and profit taking to continue as the NSEASI ranges to resist decline at strong support levels of 40,835.15bps and 41,000, just as profit booking and buying interests persist in mispriced stocks with value and high dividend-pay out, ahead of the market’s major earnings reporting season. This is especially as interest rates remain low, while oil price oscillates to sell above $55 per barrel, which is above the 2020 and 2021 budget oil benchmark price to support the Nigerian economy and equity market. There is also the likelihood of a reversal in trend and continuation, as investors position in high yields stocks ahead of earnings expectations. Also important is the fact that technical indicators reveal overbought on the weekly and daily chart, while the RSI reads 70 points and above, a situation that supports the likelihood of another correction.

However, the strong and faster recovery may continue, depending on market forces, going forward, as propelled by expected 2020 full earnings reports, while all eyes are on the outcome of next week’s MPC meeting and its outcome to give the market direction.

The NSE’s index action and indicators are looking down in the same direction on a very high traded volume and mixed sentiments.

Again, the current undervalued state of the market offers investors opportunities to position for the short, medium and long-term, which is why investors should target fundamentally sound, and dividend-paying stocks for possible capital appreciation in the rest of the year.

Meanwhile, the home study packs on INVEST 2021 New Opportunities & New Paths To Profits Summit materials and 10 Golden Stocks for 2021, Strategies and How to invest profitably in this Changing Market Dynamics/ Recession, Mastering Earnings Season For Profitable Investing and Trading in any market situation/ cycles, Life Beyond COVID 19 Investment Opportunities In The Stock Market are now available. To obtain your pack send ‘Yes’ or ‘Stock’ to 08028164085, 08179547605, 08111811223 now.

Ambrose Omordion

CRO|Investdata Consulting Ltd

info@investdataonline.com

info@investdata.com.ng

ambrose.o@investdataonline.com

ambroseconsultants@yahoo.com

Tel: 08028164085, 08032055467

https://investdata.com.ng/fear-of-rate-adjustment-at-next-mpc-meeting-halts-ngse-rally-as-investors-book-profits/

Comments

Post a Comment