Sliding Money Market Rates Push NGSE Value Up 40.20% YTD, But Correction Beckons

Market Update for November 25

The post-Monetary Policy Committee (MPC) bargain hunting continued on the Nigerian Stock Exchange (NSE) at the midweek, with the benchmark All-Share index closing higher on positive sentiments and increased transaction volume, despite being relatively below the average volume in recent times.

The renewed buying interest and high volatility reflect the inflow of funds into the equity space, considering the relative high yields as seen through the Q3 corporate earnings positions, as well as the high possibility of dividend payment at the end of the current financial year. This is despite the likelihood of dividend cut in some sectors and companies, especially as rates and yields in Treasury Bills auction crashed to 0.15% for the 364-day instruments, which was none-the-less oversubscribed.

Oil price is trading above $48 per barrel in the international market, amidst an increase the number of companies reporting the discovery of Covid 19 vaccines, even as a seamless transition of power in the United States, after an initial standoff remains a plus for global and domestic markets.

Meanwhile, earnings reports from Nigeria’s publicly traded banks were mixed and flat, even as some of them were outstanding, supporting the possibility of sustaining their dividend payout. FCMB Holdings finally released its Q3 numbers which came beyond market expectation during the midweek’s session,, with players expectedly reacting positively to it, and giving an insight into what should be expected from the nation’s second-tier banks.

Meanwhile, midweek’s trading opened in the green and was sustained throughout the session on increased buying interests in blue-chip stocks, pushing the composite NSEASI to an intraday high of 34,820.77 basis points, from its low of 34,340.56bps, closing at 34,769.00bps, higher than it opened.

Wednesday’s market technicals were positive and strong with higher volume traded than the previous day’s in the midst of breadth that favoured the bulls on a high buying pressure, as revealed by Investdata’s Sentiment Report showing 89% ‘buy’ volume and 11% sell position. Total transaction volume index stood at 0.86 points, just as momentum behind the day’s performance was strong and turning up as Money Flow Index reading 73.45 from the previous day position of 72.58 points. This is an indication that funds entered the market.

Index and Market Caps

At the end of midweek’s trading, the composite NSEASI gained 428.44bps, closing at 34,765.00bps, representing a 1.25% growth, after opening at 34,340.56bps; just as market capitalization rose by N224bn to N18.17tr, after opening at N17.94tr, which also represented 1.25% value gain in investors’ portfolios.

Attention: If you have not signed up for Investdata buy and sell signal setup, don’t delay. We have just added 20 STOCKS TO WATCH THAT ARE BUILDING NEW BULLISH BASE to our watchlist. These stocks are with double potentials to rally considering their current market prices.

To become a member, send ‘YES’ or ‘STOCKS’ to the phone numbers below. Take advantage of this service to buy right and sell right at the current market recovery ahead of portfolio reshuffling and repositioning as we await an economic reform policy to stimulate and re-track the economy again.

The day’s uptrend resulted from price appreciation in blue-chips like Dangote Cement, Lafarge Africa, Zenith Bank, Guaranty Trust Bank, Airtel Africa, Dangote Sugar, Access Bank and Julius Berger, among others. This impacted positively on the Year-To-Date gain which increase to 29.53%, while Market capitalization YTD returns stood at N5.14tr, representing a 40.20% growth above the year’s opening value.

Bullish Sector Indices

Performance indexes across sectors were largely bullish, except for the NSE Oil/Gas that closed 0.56% down, while the NSE Banking led the advancers’ after gaining 1.59%, followed by the NSE Industrial Goods, Insurance and consumer goods that closed 1.59%, 1.38% and 0.74% higher respectively.

Market breadth remained positive as advancers outweighed declinersin the ratio of 36:11, while transactions in volume and value terms were up by 19.02% and 47.35% respectively, with investors exchanging 434.92m shares worth N6.91bn, compared to the previous day’s 365.41m units valued at N4.69bn. Wednesday’s volume was driven by trades in Transcorp, Zenith Bank, Access Bank, UBA and FBNH.

May & Baker and Eterna were the best performing stocks, gaining 10% and 9.88% respectively, at N3.52 and N4.56 per share on the back of impressive earnings and market trend. On the flip side, Trans Nationwide Express and ABC Transport lost 9.38% and 8.57% respectively, closing at N0.87 and N0.32 per share, on market forces and profit booking.

Market Outlook

We expect the market to maintain the uptrend on the continued crash in money market rates and low yields in the fixed income market, as the NSE’s year-to-date return glides above inflation rate at 29.53%. This is the attraction in the stock market, as a leading indicator that can be used to hedge against inflation given the continued negative real rate of return from other investment windows.

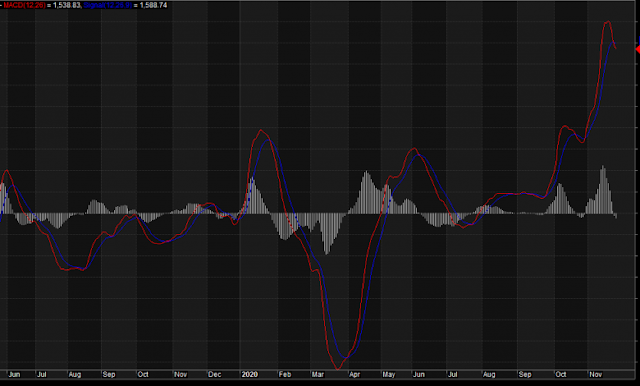

Also important is the fact that technical indicators reveal overbought on a weekly and daily chart, while RSI read 70 points and above, a situation that supports the likelihood of another correction.

However, the strong and faster recovery may continue, depending on market forces going forward. This will depend on the quality of Q3 score-cards presented, especially by the tier-1 banks, even as analyses of numbers released so far have helped repositioning of investors’ portfolios on the strength of sector and company’s performances.

The NSE’s index action and indicators are looking up in the same direction on a very high traded volume and positive buying sentiments.

Again, the current undervalued state of the market offers investors opportunities to position for the short, medium, and long-term, which is why investors should target fundamentally sound, and dividend-paying stocks for possible capital appreciation in the rest of the year.

Comments

Post a Comment