NGSE Stays Red, Blue-chip Losses Drags Benchmark Index To 26,870.38bps Intraday Low

Market Update for February 26

Stocks sold off for the fourth day in a row extending market volatility and losses as the composite Nigerian Stock Exchange All-Share Index (NSEASI), almost losing all its year-to-date gains on continued selloffs and bearish sentiments amidst for the earnings reporting season and dividend announcements, closing lower on a low traded volume.

The global markets suffered losses amounting to trillions of US$ arising from the Coronavirus outbreak now threatening the global economy already, dragging many advanced and emerging market indicators into the red on a year-to-date basis.

The market has technically broken down the major support line of 27,033.10 basis points and the 27,000bps mark as dividend news, so far, has seemingly failed to bring respite to the prevailing negative sentiments. Investors are therefore expected to change their investment strategies and risk management framework with the current earnings season expected to last till April when the 2020 Q1 scorecards will be made available to the market.

Players should look the way of high dividend-paying stocks with potentials, thereby hedging against inflation, just as companies that enjoy VAT exemptions will enjoy seeing the savings reflecting in their earnings.

The importance of liquidity in equity market cannot be overemphasized, which is one reason Investdata has repeatedly canvassed at every opportunity- through our write-ups, seminar, and presentations, that 80% movement in share price is a function of market liquidity, sectorial performance, and perception, while company performance or news influences the remaining 20%. Lack of liquidity in the market has reflected on the audited results or dividend news of African Prudential, United Capital, Zenith Bank, and Dangote Cement. The management of Dangote Cement released its audited account for the year ended 31st December 2019, with the board recommending a cash dividend of N16, with qualification and closure dates of May 25 and 26, 2020, respectively while the payment date is 16th June 2020 (READ MORE). Dangote Cement’s share price may cave in further due to weak numbers and the long closure dates of its register.

Meanwhile, Midweek’s trading opened on the downside and oscillated in the red position throughout the session, as mixed sentiment pushed the benchmark index to an intraday low of 26,870.38bps, from its high of 27,033.90bps. Thereafter, it inched up slightly but closed the day below the 27,000 psychological line at 26,974.38bps on a negative breadth.

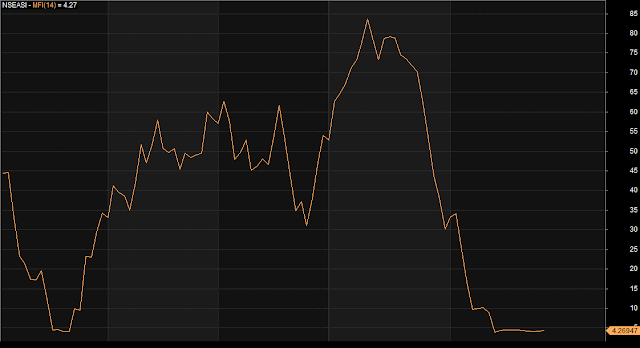

Market technicals, on Wednesday, were negative and mixed, with volume traded lower than the previous session, in the midst of negative breadth and mixed sentiment as revealed by Investdata’s Sentiment Report showing 64% ‘buy’ volume and 36% ‘sell’ position. The total transaction volume index stood at 0.83, but the energy behind the day’s performance was absolutely weak, despite a marginal rise in Money Flow Index to 4.27points, from the previous day 4.15points. This is an indication that the market is lacking in liquidity, amidst the persistent selloffs.

Index and Market Cap

At the end of midweek trading, the composite index lost 58.72bps, closing at 26,974.38bps from its 27.033.10bps opening, representing a 0.22% decline, just as market capitalization went down by N30.59bn, closing at N14.05tr, from the N14.08tr opening level, which also represented a 0.22% value loss.

Attention: If you have not signed up for Investdata buy and sell signal setup, don’t delay. We have just added another risk management feature and new stocks of most revered traders and investors in corporate Nigeria to our watchlist. These stocks are with double potentials.

To become a member, send ‘YES’ or ‘STOCKS’ to the phone numbers below. Take advantage of this service to buy right and sell right at the current market recovery ahead of full-year earnings reporting season portfolio reshuffling and repositioning as we await an economic reform policy to stimulate and re-track the economy again.

The midweek decline was impacted by selloffs in stocks like MTNN, FBNH, ETI, Vitafoam, Ucap, Sterling Bank, and Wapic Insurance, which further cut the NSE’s Year-To-Date gain to 0.49%, while market capitalization YTD gain fell to N1.09 trillion representing 8.44% growth over the year’s opening value.

Bullish Sector Indices

The sectorial performance indexes were largely bullish, except for NSE Insurance that closed 1.14% lower, while the NSE Industrial Goods index led the advancers after gaining 1.95%, followed by NSE Banking and Consumer goods which were up by 0.38% and 0.01% respectively, while Oil/Gas index was flat.

Market breadth was negative, with decliners outnumbering advancers in the ratio of 16:11, while market activities in terms of volume and value traded were down by 5.51% and 22.82% respectively as stockbrokers crossed 228.38 million shares worth N2.74 billion, from the previous day’s 241.71 million units valued at N3.55 billion. This volume was driven by trades in UBA, Zenith Bank, Access Bank, Transcrop and Ucap.

Honeywell Flourmills and FCMB were the best-performing stocks during the session, after gaining 9.38% and 6.28% respectively, closing at N1.05 and N1.86per share on market forces and dividend expectation. On the flip side, Vitafoam and Redstar Express lost 9.98% and 9.95% respectively to close at N4.06 and N3.61 on market forces

Market Outlook

We expect the losing momentum to moderate on dividend news and resist further decline as more audited earnings hit the market any moment from now. This is despite the likely continuation of the mixed intraday movement in the midst of profit-taking, with investors buying increasing positions in high dividend-paying stocks ahead of dividend declaration. This is also against the backdrop of the fact that the capital wave in the financial market may persist in the midst of relatively low-interest rates in the money market, high inflation and unstable economic outlook for 2020.

Also, investors and traders are positioning in anticipation of the 2019 full-year earnings reports, amidst the changing sentiments in the hope of improved liquidity and positive economic indices which may reverse the current trend.

We see investors focusing on the upcoming full-year earnings season, targeting companies with strong potential to grow their dividend on the strength of their earnings capacity.

Again, the current undervalued state of the market offers investors opportunities to position for the short, medium and long-term, which is why investors should target fundamentally sound, and dividend-paying stocks for possible capital appreciation in the New Year.

This was noted in the 10 golden stocks and trading ideas for 2020, as discussed extensively during the Investdata 2020 Traders & Investors Summit held in Lagos.

Also, traders and investors need to change their strategies, because of the NSE’s pricing methodology, the CBN directives and their impact on the economy in the nearest future.

Meanwhile, the Investdata team welcomes you to a bullish 2020. The home study packs of our Invest 2020 Opportunities and Trade Ideas Summit, containing the 10 Golden Stocks for 2020 are available. To obtain your pack send ‘Yes’ or ‘Stock’ to 08028164085, 08032055467, 08111811223 now.

https://investdata.com.ng/2020/02/ngse-stays-red-blue-chip-losses-drags-benchmark-index-to-25870-38bps-intraday-low/

Comments

Post a Comment